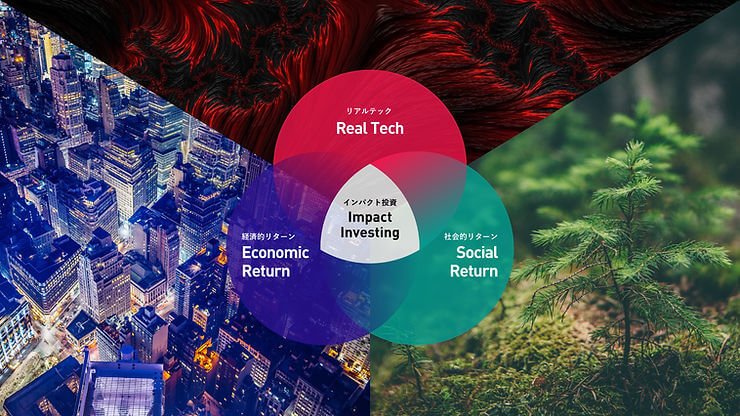

Real Tech Holdings is pleased to announce that the Glocal Deep Tech Fund (*1) has introduced impact measurement to its portfolio and will begin operations as Japan’s first deep-tech focused impact investment fund.

Since its establishment in 2015, Real Tech Holdings has been a market leader in investing and supporting deep-tech startups who solve societal and environmental challenges. It has supported startups such as Challenergy, a renewable energy startup that aims to provide safe and reliable electricity to all people by innovating wind power generation, U-MaP, a new materials startup that aims to solve heat problems caused by electronic devices, and TERRA LABO, a long-range unmanned aerial vehicle startup that enables early disaster response, amongst others.

Impact investment, which intends to generate positive social and environmental impact alongside financial return, has been gaining rapid attraction especially in Europe and the USA. The global impact investing market is estimated to be USD 715 billion as of 2020, and the Japanese market is valued at approx. USD 2.8 billion as of 2019.

To date, impact investment has predominantly focused on private equity and real assets and only limited funding has flown into deep-tech startups with transformative positive impact on society and the environment. Real Tech Holdings has decided to introduce impact measurement to ensure deep-tech startups are recognized for their true value and provide ESG/ impact investors with more attractive investment opportunities.

Real Tech Holdings has partnered with Sumitomo Mitsui Trust Bank, the leading company in sustainable finance in Japan, to assess the societal and environmental impact of its portfolio. Sumitomo Mitsui Trust Bank is an organization who is committed to bringing innovative technologies to the market and solve major societal issues, and has a strong track record in positive impact finance, which evaluates and supports corporate efforts to contribute to the SDGs in accordance with the Principles for Positive Impact Finance (*2) proposed by the United Nations Environment Programme Finance Initiative. Through this partnership, the two parties shall accelerate the effort to assess the impact of deep-tech startups and help them to bring positive impact to society.

By leading by example, Real Tech Holdings hopes to increase the number of deep-tech supporters and contribute to the future growth of the impact investment industry in Japan.

(*1) Official name: Real Tech Fund 3 Investment Limited Partnership

(*2) Principles for Positive Impact Finance

A financial framework for achieving the SDGs (Sustainable Development Goals) developed by UNEP FI in January 2017. By having companies disclose their contribution to the SDGs through KPIs and banks providing finance based on the performance of those KPIs, companies are motivated to increase their positive impact and reduce their negative impact. As responsible financial institutions, banks that provide financing monitor the KPIs to ensure that the impact continues.

About Real Tech Holdings

Real Tech Holdings is a joint venture between euglena Co.,Ltd ( https://www.euglena.jp/ ) and Leave a Nest Co., Ltd. ( https://lne.st/ ). It supports changemakers who give their heart and soul to solve societal and environmental challenges. Real Tech Holding’s manages Real Tech Fund, Japan’s leading deep-tech focused venture capital fund.

HP: https://www.realtech.holdings

For more information, please contact:

Real Tech Holdings Co.,Ltd.

Shinya Narita

contact@realtech.fund